can i get a mortgage if i didn't file a tax return

If youre asking yourself Can I get a mortgage with unfiled taxes then you should keep reading. If youre a lower earner it especially pays to file a.

Filing Taxes For Deceased With No Estate H R Block

Within the e-file process you will be asked what returns you wish to e-file.

. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. The credit is also fully refundable for 2021.

Get Terms That Meet Your Needs. What do I need to know about my refund. Generally lenders request W-2 forms going back at least two years when approving home loans.

Or refer to Publication 17 Your Federal Income Tax for Individuals. You can find online tax tools such as the. Yes you might be able to get a home loan even if you owe taxes.

To use this income you will need your most recent tax return filed and IRS processed. The interest that you pay on your mortgage. To claim the credits you have to file your 1040 and other tax forms.

You can improve your chances of mortgage approval by actively working to resolve your tax debt even if you cant pay it all off immediately. For debts incurred before December 16 2017 these numbers increase to 1 million and 500000 respectively. Failure to file penalties result in a 5 percent penalty each month on any unpaid taxes capping at 25 percent.

Didnt File mortgage return tax. Didnt File a Tax Return in 2020. You might not get very far with the mortgage application process if you have unfiled tax returns in your recent history.

Try to get a mortgage car loan or an apartment rental all. For your 2021 tax return that you will prepare in 2022 the Child Tax Credit is expanded by the American Rescue Plan raising the per-child credit to 3600 or 3000 depending on the age of your child. On the brilliant aspect if youll get a refund for some older years however you owe taxes for different older years the IRS will doubtless apply that older refund to the balances due though they wont pay you a money refund.

Interactive Tax Assistant Earned Income Tax Assistant and. The interest on an additional 100000 of debt can be deductible if certain requirements are met. The IRS will try to contact delinquent taxpayers and remind them to file.

If you dont file taxes though says La Spisa youve got all kinds of problems down the road. Borrowers employed by a family-owned business. The sooner you file the sooner the financial bleeding can stop.

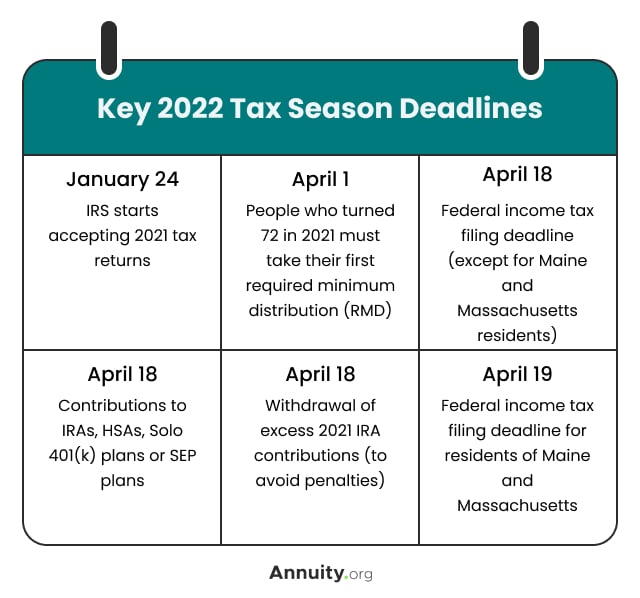

The IRS places several limits on the amount of interest that you can deduct each year. Heres Why You Should. The 2021 return must be electronically filed or postmarked by August 15 2022.

The IRS may file a return on your behalf. Lenders use tax returns to validate income in the following areas. Get Competitive Rates That Work Within Your Budget.

No you will not write off your home purchase on your income tax return. Help you get back on track. Here is how it breaks down.

Mortgage balance limitations. Ad The Best Way To Find Compare Mortgage Loan Lenders. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage.

5 percent of tax liability. Best Mortgage Lenders. However you are able to include certain items related to your home on your tax return.

Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today. The refund will. Schedule a free consultation today.

If you put on your tax return a higher mortgage interest deduction than whats on the 1098 that could easily them to get an automated letter from the. That is theyre supposed to file but will not get financial penalties if they dont. Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage debt on their primary or second home.

The deadline for claiming the 2021 refund is August 15 2022. The M1PR return can be e-filed with the Minnesota return or separately. Let us help you find the right mortgage product.

In case you file a return too late youll not be paid that refund. Find out using Do I Need to File a Tax Return. View Your Tax Account on IRSgov.

Self-employed individuals- a classic example is when you want to qualify for more house or get a bigger mortgage and you need your most recent years income in order to qualify. If you itemize you get to take such things as. Not sure if youre required to file a return.

Ad BankFive believes homeownership strengthens neighborhoods in our MA and RI communities. Backed By Reputable Lenders. If that is fruitless the IRS can calculate what it.

Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate. For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. A computer print out of tax return information obtained directly from the IRS known as a tax transcript may substitute for a tax return as it shows the line items on the originally-filed return necessary for underwriting the loan and the cost of the document may be passed along to the borrower.

In a Nutshell. You might not like it.

2022 Filing Taxes Guide Everything You Need To Know

Short Article On Vernacular Press Act This Act Was Aimed At Curbing The Freedom Of Expression Of Leaders In Their Regio Income Tax Return Income Tax Irs Taxes

Iras Inform Employees To File Tax Returns

Do You Need An Ein Employer Identification Number Due Employer Identification Number Employment Numbers

4 Reasons The Irs Can Seize Your Income Tax Refund Money For Debt Tax Refund Child Support Enforcement Take Money

How To Calculate Tax Return Tax Return Tax Brackets Tax

Do You Need To File A Tax Return In 2022 Forbes Advisor

There Are Certain Benefits That You Must Be Missing If You Did Not File Your Itr Till Now The Last Date For Fili Income Tax Return Tax Return File Income Tax

Millions Paid To File Their Taxes Last Year And Didn T Need To Tax Time Tax Return Tax Refund

The Irs Faces Backlogs From Last Year As A New Tax Filing Season Begins

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Money Savvy Income Tax

2022 No Tax Return Mortgage Options Easy Approval

Do You Need To File Taxes How Much Money You Have To Make Money

Pin On Post Your Blog Bloggers Promote Here

Home Office Tax Deductions See If You Qualify Tax Deductions Deduction Small Business Success

Thuế Thu Nhập Ca Nhan ở Mỹ Vấn đề Cần Biết Cho Người Lao động Filing Taxes Tax Refund Income Tax

Why Some Americans Should Still Wait To File Their 2020 Taxes