north dakota sales tax refund

Amazon doesnt only charge sales taxes. OK Permit Lookup System Oklahoma.

Nd Tax Website Revamped In Time For Tax Season

North Dakota imposes a sales tax on retail sales.

. A remote seller is an out-of-state retailer that has no physical presence in South Carolina. Qualifying purchases include goods purchased to be removed from North Dakota for use exclusively outside the state taxable purchases are 2500 or more per receipt and the refund request is 1500 or more. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up 132 compared to the same timeframe in 2021.

Autonomous Systems Technology AST. Corporate Income Franchise Tax. You might need to file sales tax returns depending on each state and your businesss individual circumstances.

Special Olympics North Dakota provides year-round training and athletic competition in a variety of well coached Olympic-type sports. North Carolinas maximum marginal income tax rate is the 1st highest in the United States ranking directly below North Carolinas. Refund Motor Fuel Tax Repealed 57-51.

Taxable sales and purchases for January February and March of 2022 were 47 billion. North Dakota sales tax is comprised of 2 parts. North Carolina collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

The marketplace is allowed to add the extra fee in exchange for their sales tax collection services. Supreme Court overturned the 1992 case of Quill v. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

OH Direct Pay Accounts PDF Ohio. North Dakota Legislative Branch. Tweets by NCDOR.

In Lieu of Sales Tax Fees Repealed 57-394. To obtain a refund on qualifying purchases the Canadian resident must complete the Canadian Residents Request for Sales Tax Refund Form. Gross receipts tax is applied to sales of.

TX Taxpayer Info. A sales tax is a tax paid to a governing body for the sales of certain goods and services. We may provide aggregate information about our customers sales website traffic patterns and related website information to our affiliates or reputable third parties but this information will not include.

MN Tax ID Inquiry Minnesota. North Dakota in South Dakota v. ND Sales.

Unlike the Federal Income Tax North Carolinas state income tax does not provide couples filing jointly with expanded income tax brackets. The sales tax is paid by the purchaser and collected by the seller. However Amazon collecting sales tax saves you a lot of time and energy so its probably a worthwhile trade.

NC Registration Verification of Varying Types North Carolina. On June 21 2018 the US. Individual income tax refund inquiries.

Sales Use Tax for Remote Sellers. Skip to main content. Some states require that sellers still file sales tax returns even if they only sell on marketplaces.

MD Verification of Tax Acct. Sales Use Tax. Maybe youre a natural sales person or have a knack for budgeting and finances.

MS Sales Tax Acct No. It also charges a 29 processing fee for collecting and submitting your sales tax return. The use of ground-based autonomous technologies is expected to grow exponentially in the coming years and North Dakota is working hard to lead the nation in autonomy.

Oil and Gas Gross Production Tax. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchaseWhen a tax on goods or services is paid to a governing body directly by a consumer it is usually called a use taxOften laws provide for the exemption of certain goods or services from sales and use. The NCDOR is committed to helping taxpayers comply with tax laws in order to fund public services benefiting the people of North Carolina.

If eBay collected sales tax on your behalf then it depends on how each individual state wants you to handle sales tax. Streamlined Sales and Use Tax Agreement.

North Dakota Sales Tax Small Business Guide Truic

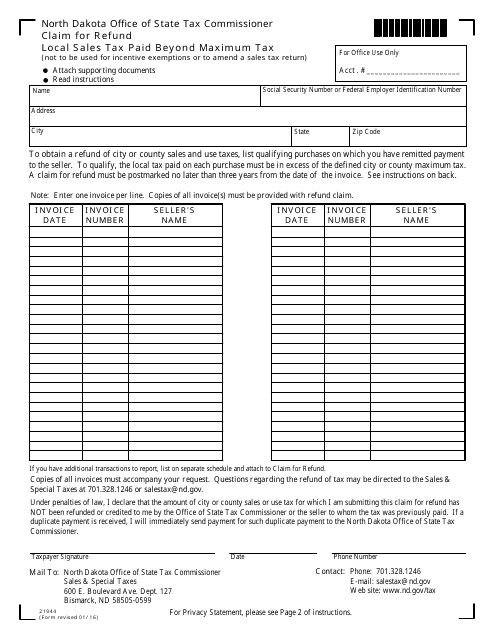

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Federal Income Tax

How To File And Pay Sales Tax In North Dakota Taxvalet

Farmland Average Value Per Acre Per State Farm Rural Land Tax Refund

Brokers Hit The Ground Running On Fatca Compliance Tax Accountant Tax Return Tax Season

New York State Map Usa Flag Stars Stripes By Patriotislanddesigns 19 50 Flag State Map Usa Flag

North Dakota Indian Maids 1911 Antique Real Photo Postcard Rppc Costly Dress 194695 American Indian Culture Native American History American Indian Clothing

Millions Of Businesses Small Medium Are Withheld From An Employee S Paycheck A Portion Is An Expense To T Sales Tax Goods And Service Tax Goods And Services

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

South Dakota South Dakota State South Dakota Aberdeen South Dakota

This Graph Shows The Average Tax Refund In Every State Tax Refund Tax America Map

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

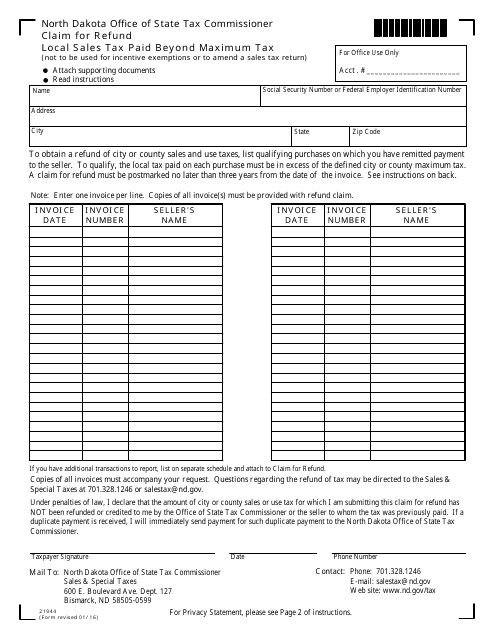

North Dakota Tax Refund Canada Form Fill Out And Sign Printable Pdf Template Signnow

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

How To File And Pay Sales Tax In North Dakota Taxvalet

Where S My Refund Of North Dakota Taxes

Where S My Refund North Dakota H R Block

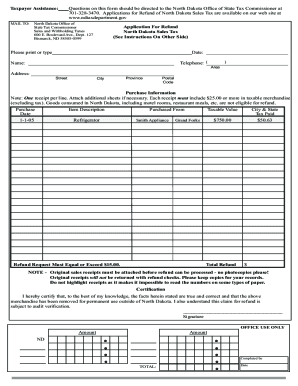

Tax Collections Climb To 1 34 Million At Sturgis Motorcycle Rally South Dakota Department Of Revenue